Little Known Facts About Stonewell Bookkeeping.

Stonewell Bookkeeping Fundamentals Explained

Table of Contents9 Simple Techniques For Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is DiscussingStonewell Bookkeeping Things To Know Before You BuyStonewell Bookkeeping Things To Know Before You BuyThe smart Trick of Stonewell Bookkeeping That Nobody is Talking About

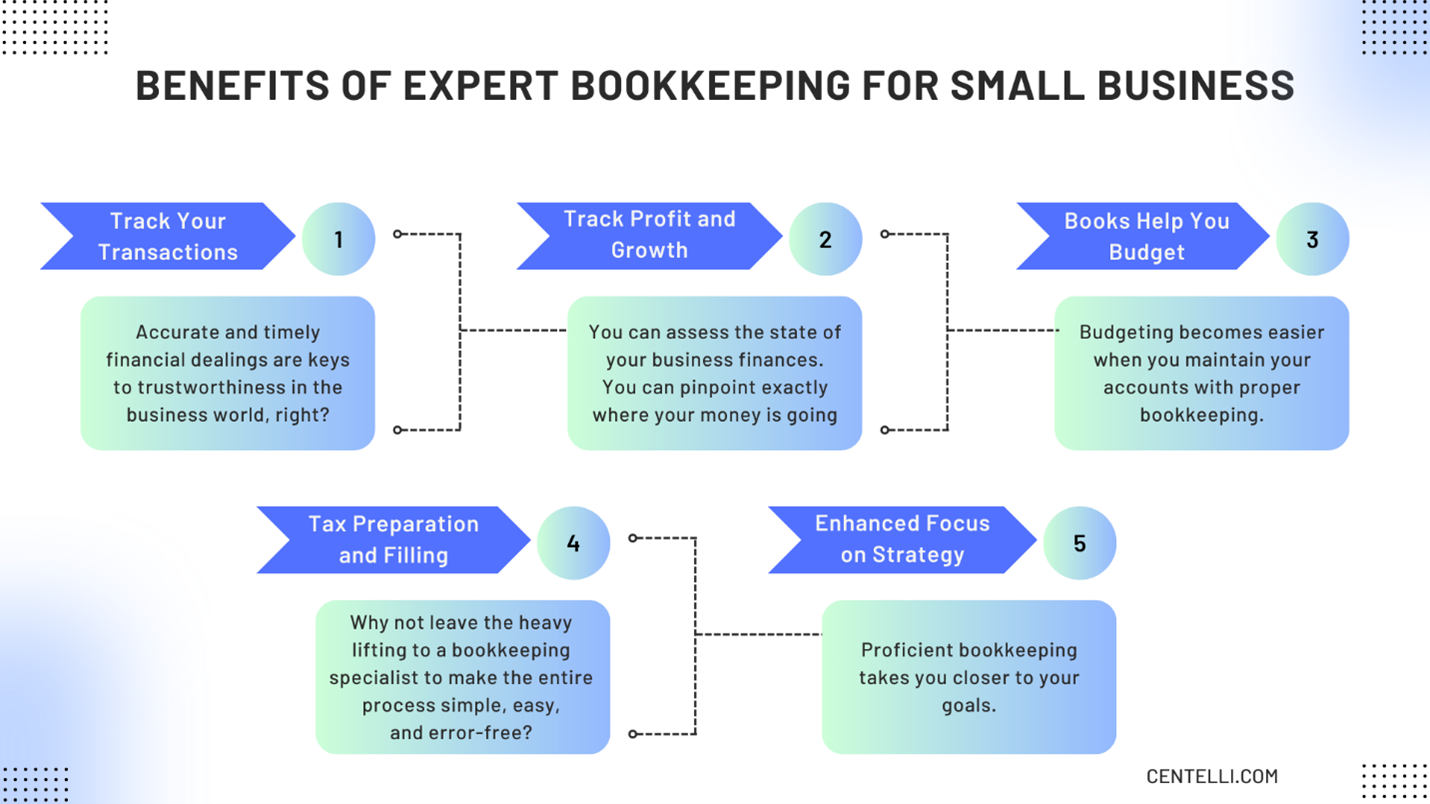

Right here, we address the question, exactly how does accounting assist a company? The real state of a firm's finances and capital is constantly in flux. In a feeling, bookkeeping books represent a picture in time, however just if they are upgraded commonly. If a business is absorbing little, an owner should act to boost earnings.

It can also solve whether or not to boost its very own compensation from clients or customers. Nonetheless, none of these conclusions are made in a vacuum cleaner as factual numerical info should copyright the financial choices of every small company. Such information is compiled via bookkeeping. Without an intimate understanding of the dynamics of your capital, every slow-paying customer, and quick-invoicing financial institution, ends up being an occasion for anxiety, and it can be a tedious and boring job.

You recognize the funds that are offered and where they drop short. The news is not always excellent, but at least you know it.

What Does Stonewell Bookkeeping Do?

The labyrinth of reductions, credit histories, exemptions, schedules, and, obviously, fines, suffices to simply surrender to the IRS, without a body of efficient paperwork to support your cases. This is why a dedicated bookkeeper is invaluable to a little organization and is worth his or her weight in gold.

Having this details in order and close at hand allows you submit your tax obligation return with ease. To be certain, a company can do every little thing right and still be subject to an IRS audit, as several currently know.

Your service return makes insurance claims and depictions and the audit intends at confirming them (https://www.quora.com/profile/Stonewell-Bookkeeping). Excellent bookkeeping is everything about attaching the dots between those representations and truth (Accounting). When auditors can comply with the info on a journal to invoices, bank declarations, and pay stubs, among others documents, they quickly discover of the proficiency and stability of the business organization

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

In the exact same way, careless bookkeeping adds to tension and anxiousness, it additionally blinds local business owner's to the possible they can realize over time. Without the details to see where you are, you are hard-pressed to set a location. Only with understandable, thorough, and accurate data can an entrepreneur or management team story a training course for future success.

Entrepreneur know finest whether a bookkeeper, accountant, or both, is the right option. Both make vital contributions to an organization, though they are not the exact same occupation. Whereas a bookkeeper can gather and organize the information required to sustain tax obligation preparation, an accountant is better matched to prepare the return itself and actually examine the revenue declaration.

This write-up will certainly explore the, including the and how it can profit your business. We'll additionally cover exactly how to begin with accounting for an audio monetary footing. Accounting involves recording and arranging monetary transactions, including sales, acquisitions, repayments, and invoices. It is the process of maintaining clear and concise records so that all financial details is easily obtainable when needed.

By routinely upgrading economic records, accounting helps organizations. This assists in conveniently r and saves organizations from the stress and anxiety of browsing for documents throughout deadlines.

The 6-Second Trick For Stonewell Bookkeeping

They are mostly concerned regarding whether their money has actually been used correctly or not. They absolutely wish to know if the business is making cash or not. They likewise would like to know what capacity the organization has. These aspects can be quickly taken care of with accounting. The earnings and loss statement, which is prepared regularly, shows the profits and also figures out the potential based on the income.

By maintaining a close eye on financial documents, services can establish practical objectives and track their progression. Normal bookkeeping ensures that companies remain certified and avoid any kind of penalties or legal issues.

Single-entry accounting is straightforward and works finest for small organizations with few transactions. It does not track possessions and liabilities, making it much less thorough compared to double-entry accounting.

The Stonewell Bookkeeping Statements

This might be daily, weekly, or monthly, read review depending on your organization's size and the quantity of transactions. Don't think twice to look for aid from an accounting professional or accountant if you discover handling your financial records testing. If you are trying to find a free walkthrough with the Accounting Option by KPI, call us today.